Quality goal is a quality goal. What are you trying to achieve? What's going on, guys? This is Alex, a part-time First Sergeant, with another two-minute drill. I'm in this video, as you saw in the link, to talk about and show you our support form. Right now, I'm coming back from my attachment armory and going to the main. This weekend, I had both the detachment soldiers and the main soldiers in order to talk about the NCOs and discuss our support forum. During the workshop, I realized that some soldiers, especially the newest ones, have never set goals for themselves. I took it for granted because in my military job, we have been doing this for years. I have been with the company for 15 years. During the workshop, I gave the soldiers a briefing on the history of the support form, what I expected from them, and provided them with a template of ideas for their goals. This month, we went over it, and I said, "Here's my insert our support form that I have used with the commander. We're going to sit down, agree to these goals, and go over them every month. I will discuss what I've achieved, what I still need to work on, and then fold it up. I want to take both copies back." My copy is the one that I'm going to carry. I'll put that back in my pocket and carry it with me. So, the following month, I'm going to pull it out of my pocket, and in about 15-20 minutes, I'm going to give it to them to look at, and then we'll have a discussion. That's the intent of getting serious about the support form. It's your counselor, and I directed all my soldiers to carry two...

Award-winning PDF software

Da 67-10-1a 2019-2025 Form: What You Should Know

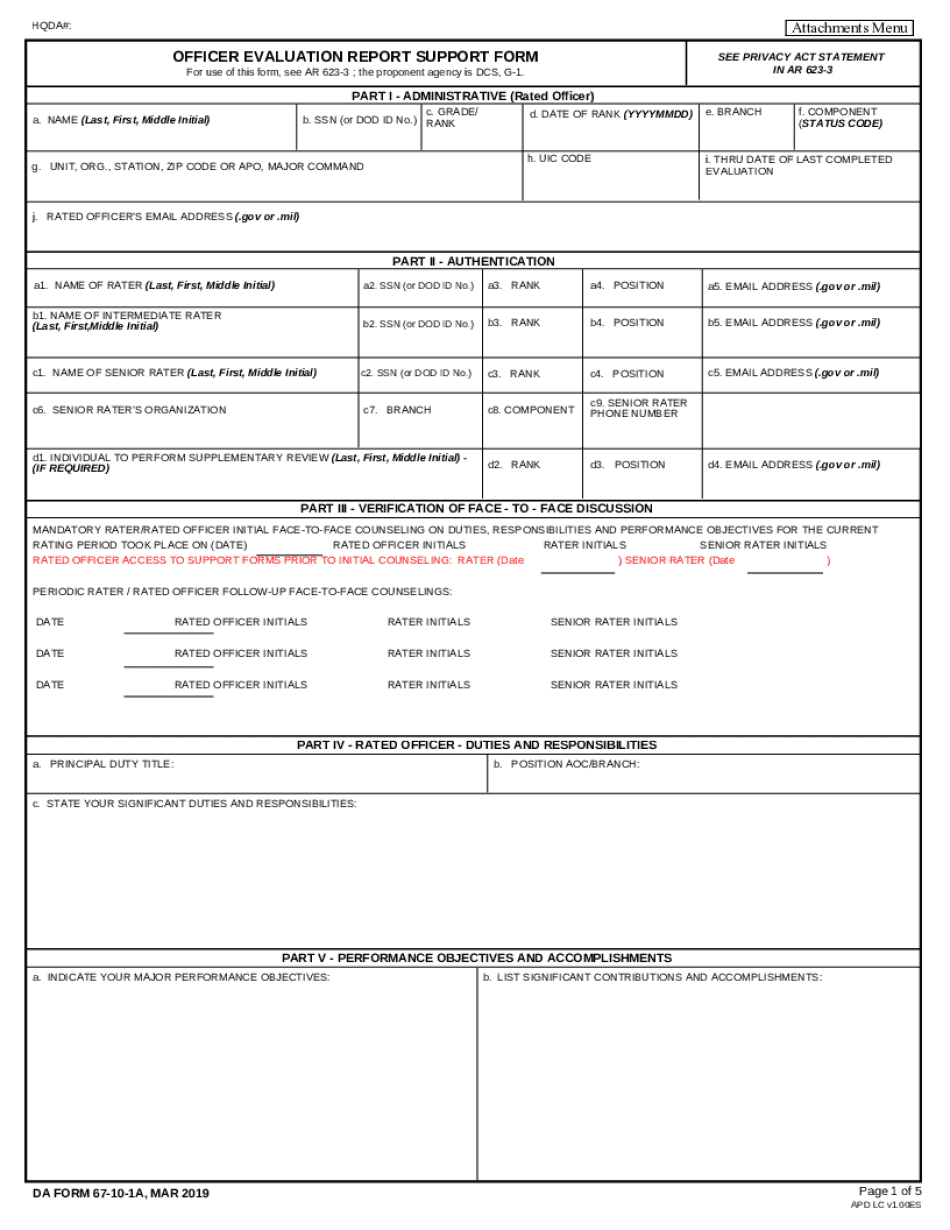

STRATEGIC GRADE PLATE GENERAL OFFICER EVALUATION REPORT This analysis report supports SHARP, EO, and EEO policies. Solely on authority, this report is completely compliant with SHARP, EO, and EEO policy on the Evaluation of Officers and Support (UFOs). The report is complete (not filled out). DA FORM 67-10-8, NOV 2015. (If you are unable to view the PDF document above, or if you are using an e-reader, please download a PDF reader here.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Da 67-10-1a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Da 67-10-1a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Da 67-10-1a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Da 67-10-1a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Da form 67-10-1a 2019-2025